There’s never been a better time for your small business to start 401(k) benefits. As of 2020, you can get a 401(k) plan with full-service retirement benefits that likely ends up costing you, the employer, a pretty small amount. There are investment expenses in every 401(k) paid by employees, but most all other setup and administration costs paid by the employer can now be cut by more than half for the first three years. How is that possible? Well, add low-cost, high-service 401(k) providers that are already affordable to the new legislation that includes powerful tax credits, and it creates the perfect storm that’ll get you and your employees on the path to retirement for minimal cost to your business.

The Secure Act Allows for Up to $16,500 in Tax Credits for Small Business 401(k) Plans

This new legislation is known as the Secure Act, and it offers meaningful tax credits to help more small businesses offer a 401(k) plan to help their employees save. If you are starting your business’ first 401(k) plan and have less than 100 employees, you can qualify for a minimum of $500 tax credit to a maximum of $5,000 for each of the first three years of your plan. This credit can be applied to 50% of your qualified business 401(k) costs such as plan setup and administration.

In addition, if you choose the automatic enrollment feature, you qualify for another $500 per year for the first three years. Automatic enrollment is a feature where an employer can choose to put all eligible employees into the plan at a set percent of salary up to 15%. Your employees can always opt out and/or choose a different percentage or amount. The automatic enrollment credit is not subject to the 50% of business cost requirement like the other tax credit, so it's dollar for dollar.

Between the small business 401(k) tax credit and the automatic enrollment credit, you can get up to $16,500 over the first three years of your new plan to offset the expenses of offering a plan. And even if you already have a plan but don’t have automatic enrollment, you can score the $1,500 in tax credits by simply adding it now. That’s free money that can go right back to your business.

How Do These 401(k) Tax Credits Work?

Here are the specifics: your business must have at least one non-highly compensated employee (someone who’s not an owner and earns less than $130,000 per year) to qualify for the tax credit. The tax credit is at minimum $500 annually or $250 per non-highly compensated employee eligible to participate, up to the maximum of $5,000 annually applied to 401(k) business costs. If the plan is setup with auto-enrollment, then another $500 credit can be tacked on for each of the three years. A four-person plan could qualify for $1,000 to $1,500 in tax credits annually and a twenty-person or more plan can qualify for $5,000 to $5,500. Know that Solo 401(k) plans – 401(k) plans designed for businesses without any full-time employees – are excluded from these credits.

An Example in Action

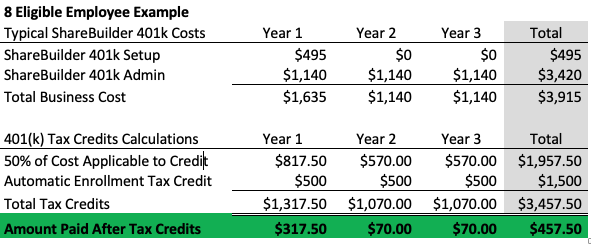

Let’s say you start your first 401(k) plan for your business today and have nine full-time employees, and eight of these employees earn less than $130,000 per year. A ShareBuilder 401k plan using Safe Harbor for 10 or less participating employees would cost $1,140 annually for administration, and there is a one-time setup of $495. In year one, you will have paid $1,635 in 401(k) plan business costs. You can qualify for $2,000 (8 * $250 = $2,000), but since only 50% of business costs can apply for the small business tax credit, you earned a tax credit for $817.50. The net of this is the tax credit cut your 401(k) plan costs in half. Yet, your costs can go lower!

If you choose to include the auto-enrollment feature, you just qualified for $1,317.50 in tax credits in this example for year one. Your plan would now have only cost you $317.50 in year one. In year two, it would only cost you $70 once the tax credits are applied (see the chart below) and the same $70 amount in year three. Over the three years, you will have applied $3,457.50 in tax credits and paid $457.50 in 401(k) business costs. That's a pretty minimal cost to offer a plan. Note that in year four you will pay the administration price without tax credits, which is still pretty darn affordable too.

Okay, But What About the Cost of Employer Matching?

Matching is pretty much $0 for your business after tax deductions. It’s important to know that matching isn’t a requirement to offer with your 401(k), but most plans do offer it. Why? It’s good for everyone, and typically all of the employer matching contributions are 100% tax deductible. Under current 2020 tax laws, the deduction for 401(k) employer contributions must not exceed 25% of the compensation paid (or accrued) during the year to your eligible employees participating in the plan. Most companies match employee contributions in the range of 3% to 7% of salary, which is typically not even close to 25%. Cash flow management is the main reason some businesses don’t match, and of these companies who opt not to match, some do a one-time or quarterly contribution or profit share into the plan. Know you have options.

What Other Costs Do I Need to Understand?

There are costs participating employees pay in every 401(k) plan. Investment expenses are the primary ongoing expense. Investment expenses include fund expense ratios. They may also include custodial, investment advisory, recordkeeping, or other costs. The main thing is to work to keep the all-in investment expenses <1% total. If you see fund expense ratios in an investment roster that are over 1% that’s a sign you may want to find a different provider that offers a roster with lower fund expenses. Other than these expenses, there can be one-off costs for transactional items like an employer needing to add a feature to the plan or perhaps an employee using the loan option.

So that’s really big news. Tax credits can cover half or more the business costs of operating a 401(k) plan for three years. Given this, 2020 is definitely a great year to add 401(k) benefits for your small business. Happy saving!

This material is intended only as general information for your convenience and should not in any way be construed as investment or tax advice by ShareBuilder 401k. The owner/participant should consult with their tax advisor regarding any specific tax strategies.