Build Your Nest Egg in 3 Simple Steps

Get your 401(k) on track for retirement today!

Three steps to starting off right with your 401(k)

There are three pretty simple steps that can help you reach your retirement savings goal. In general, experts suggest you’ll want to accumulate about 10x your salary by the time you are 67 years of age. Your income is likely to vary over your career, but with a little planning, setting yourself up for retirement can be as easy as 1 – 2 – 3!

Contribute 10%-15% of your salary to your 401(k).

Experts suggest that contributing at least 10-15% of your salary over a 30 to 40 year career will put most people in position to have the comfortable nest egg they want in retirement. If you’re unable to do 10-15% right now but your employer provides a match, at least contribute enough to receive the whole match—it’s free money. If you are unable to put in 10% of your salary now, just get started. Then, with each pay raise you receive, think about how you might give your 401(k) a raise too. If you are in your mid-30s or older you may want to consider contributing even a little more if you haven’t started.

Select a Model Portfolio if you’re new to investing.

Spreading your retirement money among stocks, bonds and cash (your asset allocation) and picking the right fund types in each category can have a big impact on reaching your goal. Our Investment Committee of financial experts makes it simple for you by managing the fund selection and asset allocation of six model portfolios ranging from Stable (income preservation) to Aggressive (potential for growth with added risk). Simply pick the one that fits you best and check in regularly to review your selection. There is no additional charge to choose one of ShareBuilder 401k’s managed models. Or you may prefer to select from our complete line-up of investment options.

Consolidate your retirement accounts to make things easy.

If you have an old 401(k) from another company or have rolled one over to an IRA, it can make a lot of sense to consolidate these into your new ShareBuilder 401k account. This helps ensure you don’t lose track of any of your retirement savings. One login, one phone number and one account are just easier to manage, and by consolidating you may keep your investment costs down too.

Other rules of thumb and investor insights

The following pages provide greater insight into investing and ShareBuilder 401k. It will provide background on why the three previous suggestions can make a lot of sense for most investors saving for retirement.

Your 401(k) tax advantages help lead to increased savings

It’s common for employees to contribute most, if not all, of their 401(k) monies on a pre-tax basis. So you’ll lower the taxes you pay this year, and then Uncle Sam will collect taxes on it when you withdraw from your account in retirement (note that for many, your tax-rate is typically lower in retirement because you’re no longer earning as much income). Not only does this ease the hit on your take home pay, it also is expected to result in some significant savings advantages over time.

Contributing to your 401(k) saves taxes this year

Your pre-tax contributions will lower your current income taxes and may not have a big impact on your take home pay either. Just consider these two hypothetical scenarios. In the first scenario, an individual is saving 10% of his salary into a regular brokerage or bank account (after tax). The second person is saving into a 401(k) and also receives a 3% employer match (your employer may or may not provide a match). Here’s how both the tax savings and retirement savings can make a big difference for the person using their 401(k):

|

Person 1

Contributes after-tax to a brokerage |

Person 2

Contributes pre-tax to a 401(k) | |

|---|---|---|

| Biweekly pay |

Contributes after-tax to a brokerage

$1,600

|

Contributes pre-tax to a 401(k)

$1,600

|

| Biweekly amount saved |

Contributes after-tax to a brokerage

$160

|

Contributes pre-tax to a 401(k)

$160

|

| Employer 3% 401(k) match |

Contributes after-tax to a brokerage

$0

|

Contributes pre-tax to a 401(k)

$48

|

| Savings per paycheck |

Contributes after-tax to a brokerage

$160

|

Contributes pre-tax to a 401(k)

$208

|

| Taxable income |

Contributes after-tax to a brokerage

$1,600

|

Contributes pre-tax to a 401(k)

$1,440

|

| Federal income tax of 20% |

Contributes after-tax to a brokerage

$320

|

Contributes pre-tax to a 401(k)

$288

|

| Take-home paycheck |

Contributes after-tax to a brokerage

$1,280

|

Contributes pre-tax to a 401(k)

$1,152

|

The person that saves 10% of his or her salary pre-tax into a 401(k):

Saves $832 in annual federal taxes by making pre-tax contributions (($320-$288) x 26 = $832)

Saves $1,248 more in retirement each year, including the 3% employer match (($208-$160) x 26 = $1,248)

Receives take-home pay that is only $128 less per paycheck ($1,280-$1,152 = $128), but saves $32 in taxes after contributions ($320-$288 = $32)

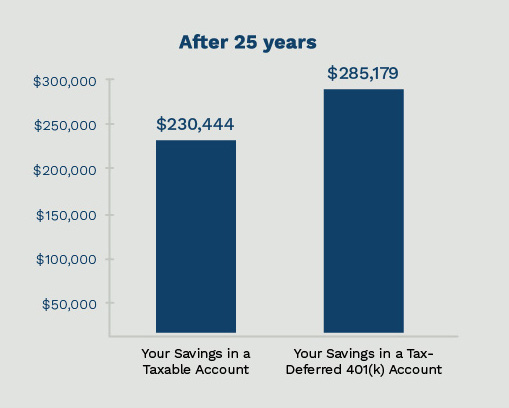

Tax-deferred savings can help you build a bigger nest egg

If you invested $350 per month in your 401(k) plan, you could end up with more in your retirement nest egg than if you saved the same amount in a taxable account. In this hypothetical example, you’ll have nearly $55K more in your 401(k) account (or 24% more) than if you had saved in a taxable account.

Note: This hypothetical illustration shows an investment of $350 a month over a period of 25 years based on a fixed 7% rate of return in both a Taxable Account and a Tax-Deferred 401(k) Account. The results include the reinvestment of all interest, but do not reflect the impact of any expenses or taxes for an actual investment, except for the deduction of federal income tax from the Taxable Account at an assumed rate of 20%. If such costs had been taken into account, the results shown would be even lower for the Taxable Account. This is a hypothetical example only. It is not intended to represent any specific type of investment and is not a guarantee of future returns. Taxes will be due on either account when withdrawn and is not considered here.

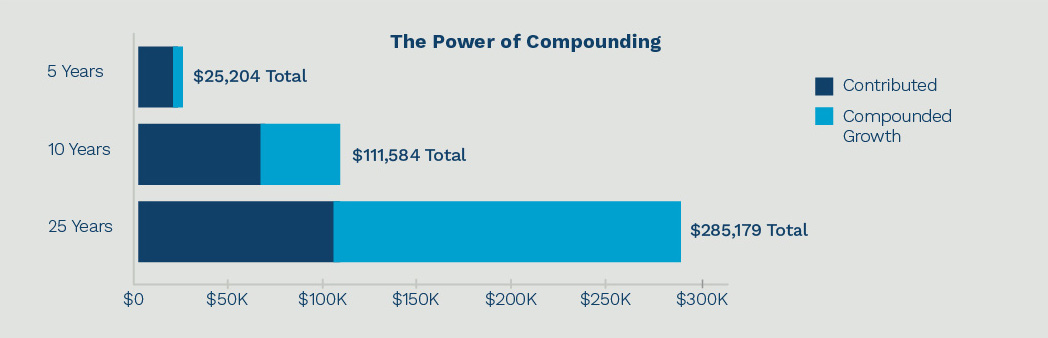

Compounding helps your money grow faster

In the above example, a person contributes $350 a month for 25 years ($105,000 total) but has $285,179 at retirement. How does this happen? Well, now look at the example below. Your investments are assumed to earn 7% each year to illustrate how this can play out. The power of compounding generates earnings from previous earnings and contributions, and this then helps you get to your retirement savings’ goal faster. The positive benefits of compounding can be seen almost immediately, but it has an even greater effect over a long period of time.

While after 5 years compounding has added 20% more to what this employee contributed, after 25 years, compounding has added $180,179, or 172% more to the employee’s contributions. Your own 401(k) account results will vary from this hypothetical example based on the return on the investments you choose and how much you contribute. There is no guarantee of compounded growth in all markets and time periods.

How much you put in stocks, bonds and cash funds is a big deal

Stocks, bonds, commodities and cash make up the main asset classes

of investing. Research shows that asset allocation has a greater

influence on overall investment performance than the specific funds

you may pick. A general rule of thumb as you consider your

allocation is to use your age for the percent to put in bonds and

the remaining in stock funds. For example, if you are 40, you’d put

40% in bonds and diversify the rest in stocks—a 40/60 split. As more

folks live longer, you may want to consider slightly more in stocks

and less in bonds, but this will depend how comfortable you are with

taking on more risk.

While many are aware that historically stocks have outperformed

bonds and bonds have beaten cash, it’s important to remember that

historically stocks are much more volatile than other asset classes.

So while stock funds can provide an important role in providing

better returns throughout your career than other asset classes, a

big drop in the markets near or during retirement—the time you start

to plan withdrawing—is unnerving and can have a significant effect

on your available retirement dollars and how comfortably you retire.

If you are unsure where to start, select a ShareBuilder 401k model

portfolio that best fits your needs today. It’s a best practice to

select “auto-rebalance.” This will automatically reset your

investment selection to the target percentage in each asset class on

an on-going basis so your investments don’t get out of whack. Do

check in on your account at least annually to ensure the funds or

the ShareBuilder 401k model portfolio you selected still match your

goals and your financial situation. For more information and to view

our current line-up visit:

The ShareBuilder 401k Investment Roster

ShareBuilder Advisors Investment Committee—

investment expertise servicing your 401(k) plan

To provide you with a high-quality* investment line-up, the

ShareBuilder Advisors Investment Committee oversees the investment

options available in your plan along with managing the make-up of

the six model portfolios.

ShareBuilder 401k is not a fund provider, and we take an unbiased

approach in selecting investments for each asset class and

sub-category. The committee consists of investment professionals

including CFAs (Chartered Financial Analysts). To assist in our

analysis, we use a model that employs a Markowitz mean-variance

technique designed to produce the highest expected return given the

variable constraints (e.g. loss limits, historical returns) for each

model portfolio. With this and other data, the fund roster and model

portfolios are managed in line with the ShareBuilder 401k Investment

Philosophy and Policy. Essential policy objectives are asset

diversification and keeping fund expenses low. Historically,

low-expense funds have outperformed high-expense funds.

In a nutshell, this means that we take a hands-on approach to ensure

you have the investments that assist you to efficiently reach your

goals. It’s a service few providers offer. We are here to deliver

you a great investment line-up to help you build a meaningful nest

egg for retirement.

To Roth or not to Roth 401(k)

Some plans offer a Roth option, which means that your contributions are made on an after-tax basis. By contributing some or all of your funds to the Roth option, you pay taxes now but these monies are not taxed again when you use them in retirement—earnings and all. Roth options are the exact opposite of contributing on a tax-deferred basis.

The Roth option can be used to hedge your tax situation when you’re ready to use your money in retirement. It’s anyone’s guess what tax rates will look like 10, 20 or 30 years from now. If you are early on in your career and you expect your earnings will grow as you advance in your career, it’s likely you will graduate to a higher tax bracket by retirement. A common strategy is to divide your contributions between pre-tax and Roth. This allows you to “hedge your bets” and provides you an extra option on how to use your savings when you reach retirement age. For instance, you can take money out of the Roth portion of your account in years when you need to spend more money (maybe a big trip or moving to that dream house on the golf course) to keep taxes in check, and use the traditional 401(k) monies at times when your spending will be lower.

*High-quality Funds: The ShareBuilder Advisors Investment Committee conducts an annual review of the Exchange-Traded Funds offered as ShareBuilder 401k fund options. This review includes multiple variables including length of time since inception, asset level, historic performance over one to ten years, expense ratio, and how the funds compare to their respective benchmark indices. Each fund is monitored and changes are made to the fund line-up as needed to align the investment options to the Investment Committee’s investment policy.